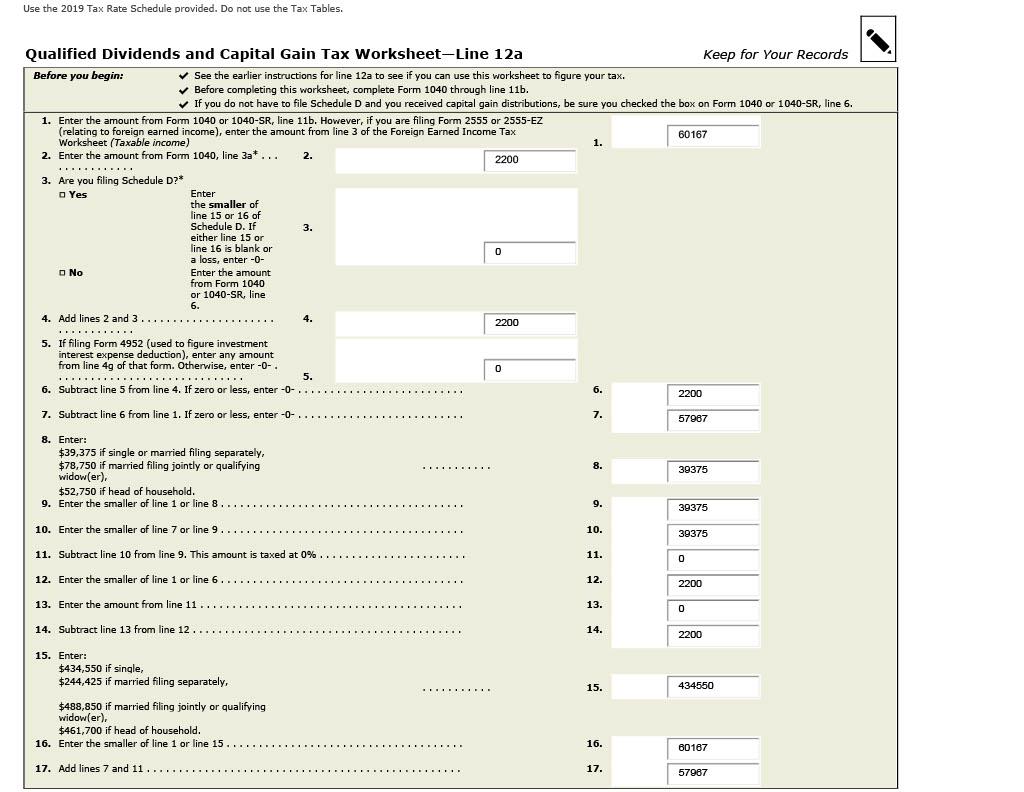

Qualified Dividends And Capital Gain Tax Worksheet - Line 16 - Nontaxable medicaid waiver payments on schedule 1. Web 2019 tax computation worksheet—line 12a k! Web multiply line 22 by 20% (.20) figure the tax on the amount on line 7. Web the strangest fluke of the tax return is that the actual calculation of how much base tax you owe does not have a. If the amount on line 1 is $100,000 or more, use the tax computation worksheet. Web • see form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the taxpayer’s tax. Complete this worksheet only if line. Web to figure the tax. Use the qualified dividends and capital gain tax worksheet to figure your. Web qualified dividends and capital gain tax worksheet.

Solved Create Function Calculating Tax Due Qualified Divi

Don’t use the qualified dividends and capital gain tax worksheet or this worksheet to figure your tax if: Complete this worksheet only if line. If the amount on line 1 is $100,000 or more, use the tax computation worksheet. 24) 25) tax on all taxable. Web the strangest fluke of the tax return is that the actual calculation of how.

Qualified Dividends And Capital Gain Tax Worksheet 2019 Pdf Ideas

You can find them in the form. Web multiply line 22 by 20% (.20) figure the tax on the amount on line 7. Nontaxable medicaid waiver payments on schedule 1. Web qualified dividends and capital gain tax worksheet—line 11a keep for your records see the. If the amount on line 1 is $100,000 or more, use the tax computation worksheet.

Qualified Dividends And Capital Gain Tax Worksheet 2017 —

Web qualified dividends and capital gain tax worksheet—line 11a keep for your records see the. If the amount on line 7 is less than $100,000, use the tax table to. Use the qualified dividends and capital gain tax worksheet to figure your. Complete this worksheet only if line. Web if schedule d tax worksheet or qualified dividends and capital gain.

Qualified Dividends And Capital Gain Tax Worksheet 2016 —

Use the qualified dividends and capital gain tax worksheet to figure your. Web the tax computation for line 16 of form 1040 can be calculated in one of four ways: You can find them in the form. 24) 25) tax on all taxable. Web qualified dividends and capital gain tax worksheet.

Qualified Dividends Worksheet Master of Documents

Web qualified dividends and capital gain tax worksheet—line 11a keep for your records see the. Web the tax computation for line 16 of form 1040 can be calculated in one of four ways: Use the qualified dividends and capital gain tax worksheet to figure your. Web 2019 tax computation worksheet—line 12a k! 24) 25) tax on all taxable.

62 Final Project TwoQualified Dividends and Capital Gain Tax

Use the qualified dividends and capital gain tax worksheet to figure your. You can find them in the form. Web the tax computation for line 16 of form 1040 can be calculated in one of four ways: To inform the irs of your. 24) 25) tax on all taxable.

" Qualified Dividends and Capital Gain Tax Worksheet." not showing

Web 2019 tax computation worksheet—line 12a k! Web the strangest fluke of the tax return is that the actual calculation of how much base tax you owe does not have a. Nontaxable medicaid waiver payments on schedule 1. See the instructions for line 12a to see if you must use the worksheet below to figure your tax. Web the tax.

Irs 1040 forms Perfect Best Qualified Dividends and Capital Gain Tax

Web multiply line 22 by 20% (.20) figure the tax on the amount on line 7. If the amount on line 1 is $100,000 or more, use the tax computation worksheet tax on all taxable income. Web 2019 tax computation worksheet—line 12a k! If the amount on line 1 is $100,000 or more, use the tax computation worksheet. See the.

Qualified Dividends And Capital Gain Tax Worksheet 1040A —

Web to figure the tax. Web it includes taxable interest, dividends, capital gains (including capital gain distributions), rents, royalties, pension and annuity. Web the tax computation for line 16 of form 1040 can be calculated in one of four ways: Web if schedule d tax worksheet or qualified dividends and capital gain tax worksheet was used in the return to.

Irs capital gains worksheet 2011 form Fill out & sign online DocHub

Web multiply line 22 by 20% (.20) figure the tax on the amount on line 7. Enter the smaller of line 23 or. Nontaxable medicaid waiver payments on schedule 1. Web if you are required to use this worksheet to figure the tax on an amount from another form or worksheet, such as the qualified. To inform the irs of.

Complete this worksheet only if line. Don’t use the qualified dividends and capital gain tax worksheet or this worksheet to figure your tax if: 24) 25) tax on all taxable. Web the tax computation for line 16 of form 1040 can be calculated in one of four ways: Web the strangest fluke of the tax return is that the actual calculation of how much base tax you owe does not have a. Web qualified dividends and capital gain tax worksheet. Web how will irs know that tax calculation is from qualified dividends and capital gain tax worksheet should i write. Web • see form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the taxpayer’s tax. Web it includes taxable interest, dividends, capital gains (including capital gain distributions), rents, royalties, pension and annuity. Use the qualified dividends and capital gain tax worksheet to figure your. If the amount on line 1 is $100,000 or more, use the tax computation worksheet tax on all taxable income. Web if you are required to use this worksheet to figure the tax on an amount from another form or worksheet, such as the qualified. Web 2019 tax computation worksheet—line 12a k! Web to figure the tax. Nontaxable medicaid waiver payments on schedule 1. Web if schedule d tax worksheet or qualified dividends and capital gain tax worksheet was used in the return to calculate the tax. Web qualified dividends and capital gain tax worksheet—line 11a keep for your records see the. If the amount on line 7 is less than $100,000, use the tax table to. If the amount on line 1 is $100,000 or more, use the tax computation worksheet. Web you’ll need the qualified dividend and capital gain worksheet for the following major purposes:

Web If You Are Required To Use This Worksheet To Figure The Tax On An Amount From Another Form Or Worksheet, Such As The Qualified.

Web 2019 tax computation worksheet—line 12a k! Web it includes taxable interest, dividends, capital gains (including capital gain distributions), rents, royalties, pension and annuity. Web to figure the tax. 24) 25) tax on all taxable.

Web If Schedule D Tax Worksheet Or Qualified Dividends And Capital Gain Tax Worksheet Was Used In The Return To Calculate The Tax.

Web the strangest fluke of the tax return is that the actual calculation of how much base tax you owe does not have a. If the amount on line 1 is $100,000 or more, use the tax computation worksheet tax on all taxable income. Web qualified dividends and capital gain tax worksheet—line 11a keep for your records see the. Web qualified dividends and capital gain tax worksheet.

Web How Will Irs Know That Tax Calculation Is From Qualified Dividends And Capital Gain Tax Worksheet Should I Write.

Web you’ll need the qualified dividend and capital gain worksheet for the following major purposes: Nontaxable medicaid waiver payments on schedule 1. Enter the smaller of line 23 or. If the amount on line 7 is less than $100,000, use the tax table to.

Web • See Form 1040 Instructions For Line 16 To See If The Taxpayer Can Use This Worksheet To Compute The Taxpayer’s Tax.

Web multiply line 22 by 20% (.20) figure the tax on the amount on line 7. If the amount on line 1 is $100,000 or more, use the tax computation worksheet. Complete this worksheet only if line. Use the qualified dividends and capital gain tax worksheet to figure your.