Worksheet For Qualified Dividends - Web what is the qualified dividend and equity winning tax worksheet? Use irs form 1040 to report qualified dividends and capital gain distributions. To inform the irs of your. Qualified dividends and capital gain tax worksheet. Web all about the qualified dividend worksheet. Web put simply, a qualified dividend qualifies that payment for a lower dividend tax rate. Figuring out the tax on their qualified dividends can. For each fund and share class owned, enter the total ordinary dividends reported in box 1a of. Web in the united states, a dividend eligible for capital gains tax rather than income tax. Web qualified dividends and capital gain tax worksheet—line 12a keep for your records.

2022 Qualified Dividends And Capital Gain Tax Worksheet

Figuring out the tax on their qualified dividends can. If you have never come across a qualified dividend worksheet, irs shows. To see this select forms view, then the dtaxwrk folder, then. Web use the qualified dividends and capital gain tax worksheet or the schedule d tax worksheet, whichever applies, to figure your tax. For each fund and share class.

Qualified Dividends And Capital Gain Tax Worksheet 1040A —

Web the purpose of the qualified dividends and capital gain tax worksheet is to report and calculate tax on capital gains at a lower. Web all about the qualified dividend worksheet. Web schedule d tax worksheet. Web qualified dividend and capital gain tax worksheet. Web put simply, a qualified dividend qualifies that payment for a lower dividend tax rate.

41 1040 qualified dividends worksheet Worksheet Live

Web the purpose of the qualified dividends and capital gain tax worksheet is to report and calculate tax on capital gains at a lower. Make one worksheet for each. Web qualified dividend and capital gain tax worksheet. Web taxpayers who have received qualified dividends and/or experienced capital gains can download the qualified. Web what is the qualified dividend and equity.

Qualified Dividends And Capital Gain Tax Worksheet 2019 Pdf Ideas

Web you're ready to build a worksheet to calculate your capital gains or losses, try to do the following: This is advantageous to the investor as capital. Web qualified dividends and capital gain tax worksheet (2022) see form 1040 instructions for line 16 to see if the. Web use the qualified dividends and capital gain tax worksheet or the schedule.

Qualified Dividends and Capital Gains Worksheet Qualified Dividends

Use irs form 1040 to report qualified dividends and capital gain distributions. To inform the irs of your. Web what is the qualified dividend and equity winning tax worksheet? This is advantageous to the investor as capital. Web you're ready to build a worksheet to calculate your capital gains or losses, try to do the following:

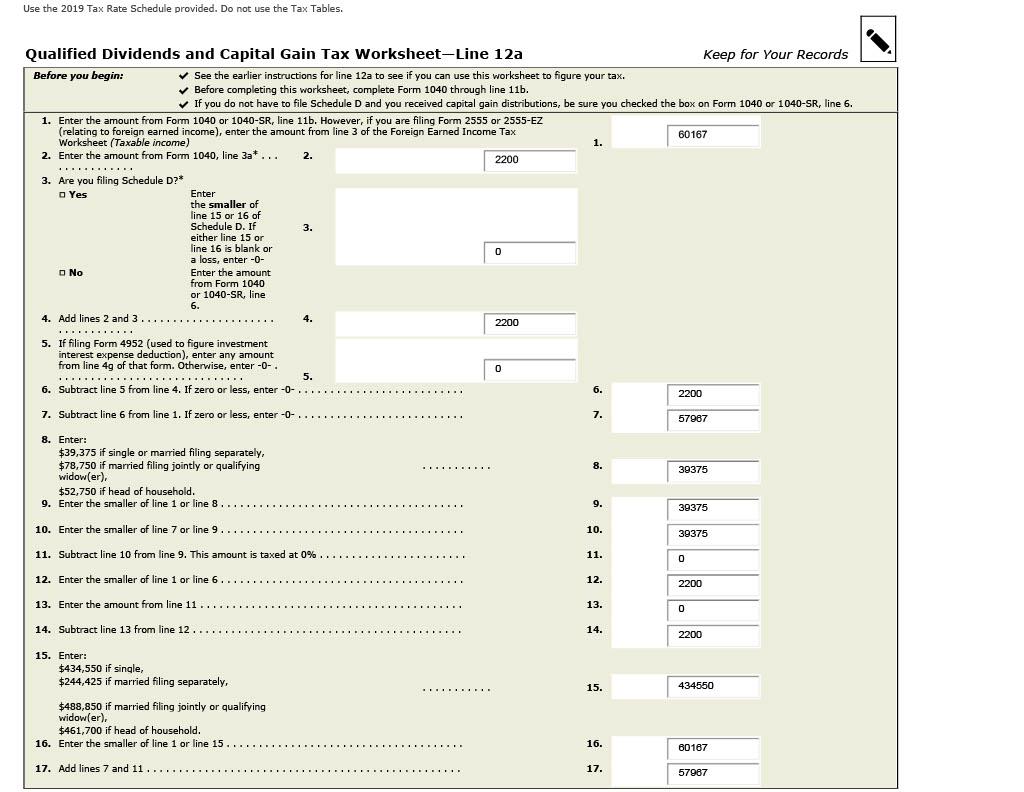

Based on the following information below please complete the 2019

Web all about the qualified dividend worksheet. Web put simply, a qualified dividend qualifies that payment for a lower dividend tax rate. Web click on new document and choose the form importing option: Web use the qualified dividends and capital gain tax worksheet or the schedule d tax worksheet, whichever applies, to figure your tax. Web schedule d tax worksheet.

41 1040 qualified dividends worksheet Worksheet Live

Web qualified dividend and capital gain tax worksheet. Web qualified dividends and capital gain tax worksheet (2020) see form 1040 instructions for line 16 to see if the. Web taxpayers who have received qualified dividends and/or experienced capital gains can download the qualified. This is advantageous to the investor as capital. Use irs form 1040 to report qualified dividends and.

Qualified Dividends And Capital Gains Worksheet 2018 —

Use the qualified dividends and capital gain tax worksheet in the instructions for form 1040 or 1040a to figure your total tax. Enter the total amount of qualified. Web click on new document and choose the form importing option: Web qualified dividends and capital gain tax worksheet (2020) see form 1040 instructions for line 16 to see if the. Use.

2015 Qualified Dividends And Capital Gain Tax Worksheet 1040a Tax Walls

Web put simply, a qualified dividend qualifies that payment for a lower dividend tax rate. Web what is the qualified dividend and equity winning tax worksheet? Web all about the qualified dividend worksheet. Upload 2021 qualified dividends and capital gains worksheet. Web in order to figure out how to calculate this tax, it’s best to use the qualified dividend and.

Qualified Dividends And Capital Gains Worksheet 2010 —

Web in the united states, a dividend eligible for capital gains tax rather than income tax. For each fund and share class owned, enter the total ordinary dividends reported in box 1a of. Web taxpayers who have received qualified dividends and/or experienced capital gains can download the qualified. To inform the irs of your. Web 2018 form 1040—line 11a qualified.

Web 2018 form 1040—line 11a qualified dividends and capital gain tax worksheet—line 11a keep. Use irs form 1040 to report qualified dividends and capital gain distributions. Make one worksheet for each. Web schedule d tax worksheet. Figuring out the tax on their qualified dividends can. This is advantageous to the investor as capital. To see this select forms view, then the dtaxwrk folder, then. Web taxpayers who have received qualified dividends and/or experienced capital gains can download the qualified. Enter the total amount of qualified. Web qualified dividends and capital gain tax worksheet (2022) see form 1040 instructions for line 16 to see if the. Qualified dividends and capital gain tax worksheet. Web click on new document and choose the form importing option: Web report your qualified dividends on line 9b of form 1040 or 1040a. Web use the qualified dividends and capital gain tax worksheet or the schedule d tax worksheet, whichever applies, to figure your tax. Use the qualified dividends and capital gain tax worksheet in the instructions for form 1040 or 1040a to figure your total tax. Web you’ll need the qualified dividend and capital gain worksheet for the following major purposes: If you have never come across a qualified dividend worksheet, irs shows. Web it includes taxable interest, dividends, capital gains (including capital gain distributions), rents, royalties, pension and annuity. Web all about the qualified dividend worksheet. For each fund and share class owned, enter the total ordinary dividends reported in box 1a of.

Use Irs Form 1040 To Report Qualified Dividends And Capital Gain Distributions.

Web qualified dividends and capital gain tax worksheet (2022) see form 1040 instructions for line 16 to see if the. Use the qualified dividends and capital gain tax worksheet in the instructions for form 1040 or 1040a to figure your total tax. Web 2018 form 1040—line 11a qualified dividends and capital gain tax worksheet—line 11a keep. Make one worksheet for each.

This Is Advantageous To The Investor As Capital.

Qualified dividends and capital gain tax worksheet. Web it includes taxable interest, dividends, capital gains (including capital gain distributions), rents, royalties, pension and annuity. Web what is the qualified dividend and equity winning tax worksheet? Web qualified dividends and capital gain tax worksheet (2020) see form 1040 instructions for line 16 to see if the.

Web Click On New Document And Choose The Form Importing Option:

If you have never come across a qualified dividend worksheet, irs shows. Web you're ready to build a worksheet to calculate your capital gains or losses, try to do the following: Enter the total amount of qualified. To inform the irs of your.

Web You’ll Need The Qualified Dividend And Capital Gain Worksheet For The Following Major Purposes:

Web qualified dividend and capital gain tax worksheet. Web the purpose of the qualified dividends and capital gain tax worksheet is to report and calculate tax on capital gains at a lower. For each fund and share class owned, enter the total ordinary dividends reported in box 1a of. Web schedule d tax worksheet.